The firm was founded in 2002 by Ronald Dickerman, Madison’s President, with the idea of building a global investment platform focused on providing liquidity to real estate owners and investors who otherwise had few options for facilitating early exits from their illiquid real estate ownership positions or monetizing embedded equity. Today, with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Amsterdam and Singapore and a full team of professionals dedicated to the sourcing, underwriting, acquisition, asset management and investor relations, Madison has become a global leader in providing equity capital in a diverse range of real estate transactions involving class A properties and portfolios.

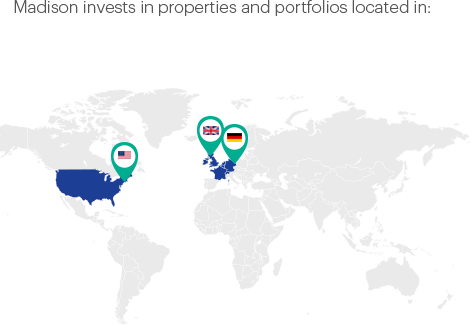

Madison focuses on capital partner replacements, equity monetizations and recapitalizations of class A properties and portfolios located throughout the US, UK and Western Europe as well as investments in public/private companies owning similar quality properties. Since inception, Madison has raised over $8 billion in capital commitments from more than 175 institutional investors around the world.

Liquidity Solutions Across the Real Estate Spectrum

Capital Partner Replacements

Madison purchases interests in indirect or illiquid ownership structures

Equity Monetization

Madison provides capital to owners seeking to monetize embedded equity value in their assets and portfolios

Recapitalizations

Madison provides equity capital to owners seeking to recapitalize the balance sheets of their existing properties and portfolios

Public Company Investments

Madison specializes in custom equity solutions for a wide range of real estate financings

End of Fund Life

Madison seeks to offer those planning their end of fund life situations a strategic liquidity alternative

Real Estate Growth Platform Investments

Madison aims to provide flexible capital solutions to owners, operators, and/or managers of growing real estate platforms

Preferred Asset Types

Madison's Investment Size

Geographic Locations

15

Years in Business

$5.4 BILLION

Capital commitments from more than 150 worldwide institutional investors

Madison International Realty Timeline

2002

- Madison is founded by Ronald Dickerman, with a focus on providing liquidity to real estate investors worldwide.

- Madison closes its first fund with $90.0 million in capital commitments, with an additional raise of $12.5 million the following year.

- Madison opens its Frankfurt office to expand its Western European platform.

2003

- Madison invests in 300 Park Avenue, its first investment in the New York City office market.

2004

- Madison invests in 375 Park Avenue, an iconic, Class A, trophy-quality office property located in Midtown Manhattan.

2005

- Madison closes its second fund with $84.7 million in capital commitments.

2006

- Madison closes its largest German transaction to date with an investment in a 5-asset office and healthcare portfolio located throughout Germany.

2007

- Madison closes its third fund with $303.8 million in capital commitments.

2008

- Madison enters the London market with the closing of Devonshire House, a rarely traded, trophy-quality office building located in the Mayfair submarket of London’s West End.

2009

- Madison closes on its second London asset with an investment in the Lloyd’s of London Building, an iconic, class A, high rise office building located in the heart of the financial district in London.

2010

- Madison opens its London office to further focus on the U.K. and Irish markets.

2011

- Madison closes its fourth fund with $520.4 million in capital commitments.

- Madison closes on the Forest City NYC Core Retail Portfolio, the largest investment in the firm’s history; the portfolio includes a prominent 42nd Street/Times Square property as well as two office/retail properties adjacent to the new Barclays Center Arena in Brooklyn.

2012

- Madison enters the Frankfurt market with the acquisition of a 50% interest in the Trianon, a premier 700,000 sf class A office tower located in Frankfurt’s financial district.

- Madison enters the Scandinavian market with an investment in the Statoil Building in Oslo, a class A office building and winner of the World Architecture Building of the Year Award for commercial properties in 2012.

2013

- Madison acquires a 49% interest in One California Plaza located in downtown Los Angeles, the firm’s largest west coast investment to date.

- Madison closes its fifth fund with $825 million in capital commitments.

- Madison acquires a stake in property fund DB Immobilienfonds 13 California, the owner of the SAKS Fifth Avenue building on Union Square in San Francisco.

2014

- Madison Frankfurt office relocates and expands.

- Madison formalizes a commitment to the community through its newly launched Corporate Philanthropy Program.

- Madison acquires additional interest in the Statoil complex in Oslo.

2015

- Madison acquires 7.8% of the outstanding shares of Monogram Residential Trust.

- Madison launches its mentoring program, holding the first mentoring event at Madison’s New York office.

- Madison completes sale of the Trianon Office Tower, which was owned by Madison and the Morgan Stanley Eurozone Office Fund.

2016

- Madison invests into HBS, the owner of 80 prominent retail assets in the United States and Germany.

- Madison closes its sixth fund with $1.39 billion of equity commitments, including sidecars, co-investments, and GP commitments.

- Madison completes the sale of the Statoil office complex in Oslo.

- Madison’s London office relocates and expands.

- Madison acquires 50% stake in two Paternoster Square assets.

- Madison launches systematic tender offer on a Deutsche Bank-sponsored, closed-end owning Deutsche Bank’s global headquarters in the heart of Frankfurt’s CBD.

2017

- Madison International Realty recapitalizes a joint venture between DDR and various LP equity investors consisting of 52 shopping centers. Madison replaced the LP equity investors and DDR remained in the joint venture as the GP and operator.

2018

- Madison International Realty partners with Ghelamco to acquire 50% stake in Warsaw Spire tower.

2019

- Madison International Realty Wins PERE Award for Indirect Firm of the Year: Global

The above-mentioned industry award was received by Madison for the 2019 annual year. The award is presented by Private Equity Real Estate Publication (‘PERE”) and based on independent voting participation by industry individuals. Madison officially received its 2019 award on March 1, 2020. There was no cash or non-cash compensation provided to participants in exchange for their vote. This is not an endorsement of Madison by any of the above referenced organizations.

2020

- Madison International Realty Signs United Nations Supported Principles of Responsible Investment.

2021

- Madison International Realty HQ NYC Office moves to expanded office at 300 Park Avenue

- Madison International Realty Wins PERE Award for Indirect Firm of the Year: Global

The above-mentioned industry award was received by Madison for the 2021 annual year. The award is presented by Private Equity Real Estate Publication (‘PERE”) and based on independent voting participation by industry individuals. Madison officially received its 2021 award on March 1, 2022. There was no cash or non-cash compensation provided to participants in exchange for their vote. This is not an endorsement of Madison by any of the above referenced organizations.